As a company servicing the debt collection industry it is vitally important to partner with the “right” clients. Minimizing risk, while maximizing profit has never been as important as it is right now.

I have heard countless stories how my peers have gone through months and months of a sales cycle – hosting auditors, filling out endless RFP’s and Security Questionnaires – only to get to the finish line and hear, “we would like to hire you and our contingency rate is 15%”. Standard reply….”Hell no! That might be a great contingency rate for accounts that are 60 days past due but for seconds over my dead body!”

Leveraging Surefire Analytics, we would suggest you take pause before telling such a client to go fly a kite! Let’s take a closer look at the details.

First, let’s examine reputational risk. Is this a company that is going to cause headaches with the CFPB, AG’s office or BBB? How much time do you invest researching your prospect? What are their business practices? How do they treat their consumers? What products do they provide? Sure, all seem like obvious questions but time and time again I’m hearing stories of lessons learned the hard way.

For example, I know of one collection law firm that fired a dentist because they would hold dentures as collateral until the patient paid the bill! Almost funny to recall in hindsight, hearing the story of a lawyer going to court where the patient showed up without his dentures and proceeded to describe how he went in for a simple cleaning. Once giving up his dentures for the service, he found out the dentist wouldn’t give them back, until the bill was paid. The attorney simply stood there listening, as the judge stared at him as if it was his business practice that did this to the poor man. The first thing that lawyer did when he got back to his office was fire his client!

Today, information related to companies and the product/services they provide is everywhere. A little research on the front end can save your firm a substantial amount of resources. Once you sign that contract and start accepting placements you might as well have slipped a ring on their finger.

After reviewing the reputational risk brought along with a new client, there are a couple quick hit items to consider.

As we have read in the past couple of weeks one of the most important questions is can they produce documentation associated with the bill at the time of placement. This would be not only the documentation needed to validate the claim but to respond to a verification of debt request as well as if you are a law firm the documentation needed to take the account to judgment.

Next up, I will ask if they are a debt buyer licensed in all fifty states? I am surprised still today of how many times I hear the word “no”. I am not sure what rock these debt buyers have been living under but this can cause you and the servicer a lot of problems down the road.

So now we have reputational risk and a few quick points covered…let’s get into the heart of the matter, profitability.

When analyzing the potential profitability of a new client, here are the questions I ask. Once I have these answers and completely understand the risks associated with the client and their business practices, I can accurately forecast the financial impact this new client will have on the firm.

* How many files per month will be placed?

* What is the contingency rate or are you asking me to quote it?

* What is the average balance?

* What is the expected liquidation at 12 and 24 months?

* Is there a concentration of accounts in a certain state or does it follow a typical distribution model of each states population?

Let’s break down each question, starting with the first: How many files per month will be placed?

There is no wrong answer from a client in my opinion of how many files they have. I have very profitable clients that place 10 accounts per month and I have marginally profitable clients that place 2,000 accounts a month. The item to watch here and/or to try and anticipate is the services which will be required to support the client. You can eat up all of your profit, very quickly, if a small volume client is calling you each day for a status on all of the files placed. Just as much as you can eat up all of your profit on a high volume client that that is auditing you four times a month while making you run weekly fire drills with your entire staff.

Once you have the answers to the 2nd, 3rd and 4th questions, we can start to model and forecast dollars.

Fee per File and Cost per File have been metrics I’ve used to manage client relationships for years and they have proven to be invaluable when forecasting profitability. Let’s take a closer look at these metrics.

Fee per File = (((AB x FP) x LR) x CR) /FP

AB Average Balance

FP Files Placed per Month

LR Liquidation Rate

CR Contingency Rate

Let’s work this through with an example. You have regional bank A that calls up and wants to place 1,000 files per month with an average balance of $2,500 with an expected liquidation rate of 10.56% at 12 months and 17% at 24 months. They are asking if you would accept a 24% contingency rate.

(($2,500 x 1,000) x 10.56%) x 24% = $63,360/1,000

12 Month Fee per File = $63.36/File

(($2,500 x 1,000) x 17.00%) x 24% = $102,000/1,000

24 Month Fee per File = $102.00/File

To understand how your income relates to your expenses we need another formula. For our example, let’s assume you get in 3,500 files per month or 42,000 files per year. Let’s also say your total expenses including the partners salaries are $2,900,000.00 per year.

Using a simple Cost per File equation, taking total costs divided by the number of accounts placed, we quickly know it costs the firm $69.04 per file handled, across all clients ($2.9MM/42,000 accountings).

If you treat Regional Bank A like all your other clients you will lose money year 1 and in year 2 you will start making a profit of $32.96 per file.

Now, what if the Regional Bank A said they have an average balance of $9,000, they will place 1,000 accounts, with a year 1 liquidation rate of 18% and year 2 of 27%? But, the commission rate is 15%.

(($9,000 x 1,000) x 18.00%) x 15% = $243,000/1,000

12 Month Fee per File = $243.00/File

(($9,000 x 1,000) x 27.00%) x 15% = $364,500/1,000

24 Month Fee per File = $364.50/File

Understand the firm cost is $69.04/File…if were offered 15% contingency rate in scenario 2, I’d say hell yes!

Typically, the liquidation of a file changes of course of where it has been before it got to you and what type of paper it is. I have found that using your own reporting is key to establishing a correct commission rate or at least understanding if you are going to lose money year 1 and how much you are going to make in year 2 or Year 3. Some of our Surefire clients call it the B.S. detector to determine if the commission rate is fair.

Regulatory compliance and client performance are issues that are only going to get more expansive, more detailed and more important for everyone in the debt collection industry to track, trend and improve upon. We must change our thinking and look for innovative strategies to do our business better. After all, you cannot use yesterday’s methods today and be in business tomorrow. Contact Us if you would like to Operate Smarter!

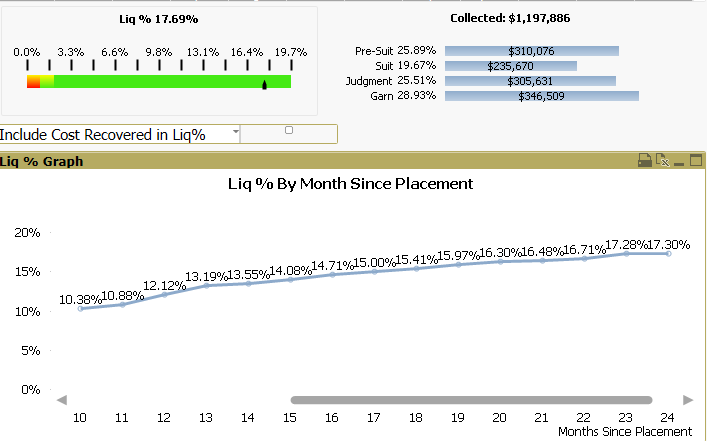

Below are a few examples of how our clients use the Surefire platform to ensure they just didn’t lose money!