We can no longer use ignorance as an excuse for how we operate within the ARM industry. Regardless of if we are discussing a performance metric or a compliance metric if you respond with “I didn’t know,” “I don’t know,” or “how would I know,” it suggests to me that you cannot pull the data into a standard report; this is a recipe for disaster. Many collection agencies and collection law firms operate today without the ability to run the reports they need to run their business. In addition, they are unable to know if an operational or compliance measure is not working correctly or if an employee didn’t follow a procedure.

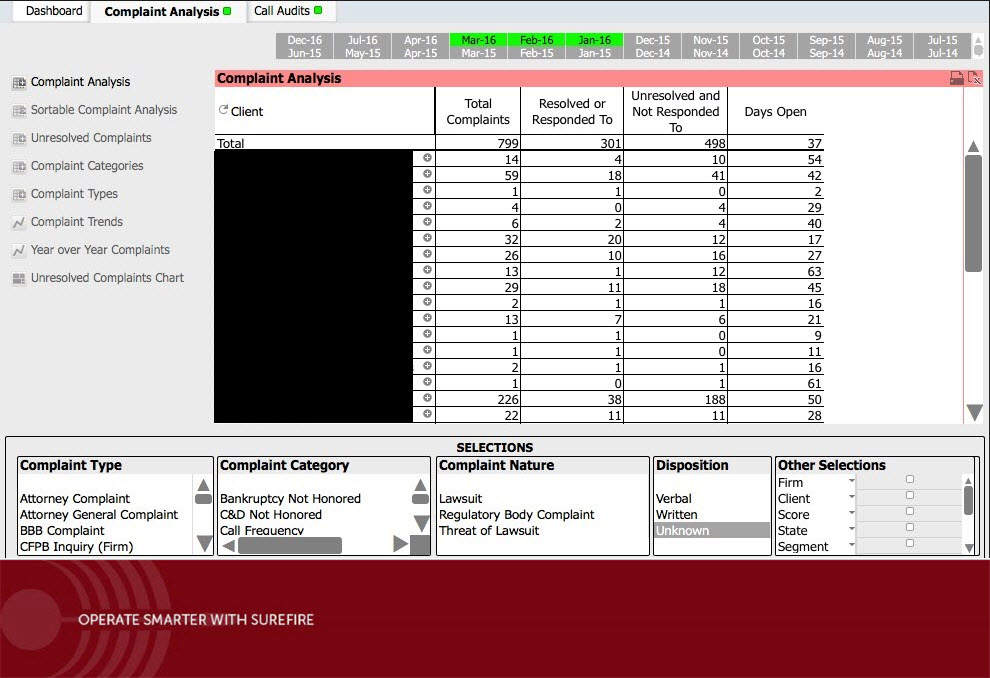

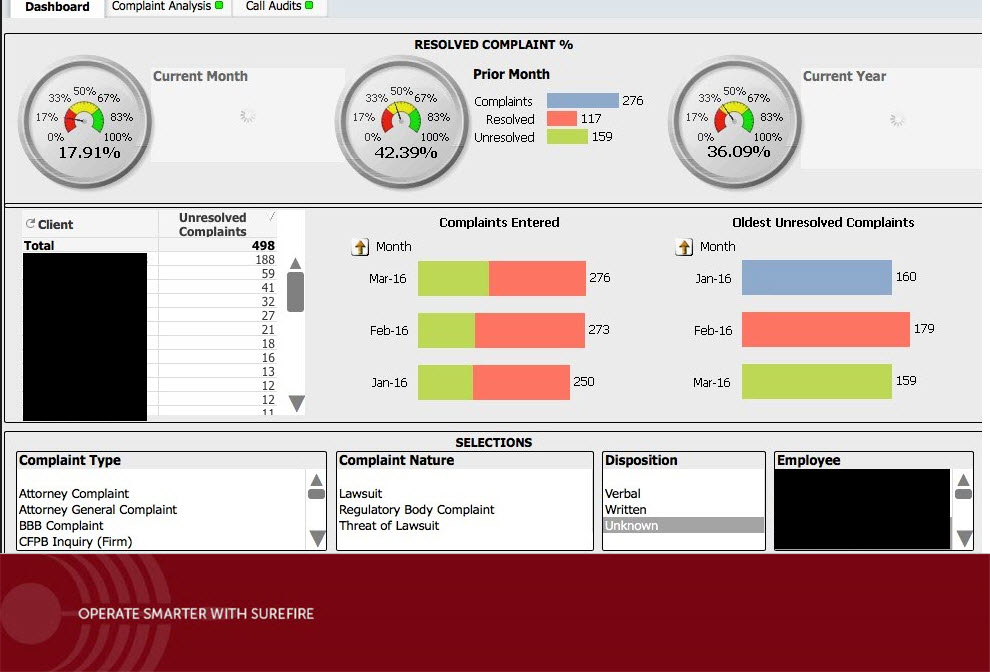

Is there one client that gets the most complaints? Is one employee responsible for most of the complaints? Where are the complaints coming from? “I didn’t know…” “I don’t know… “ or “how would I know?”

The industry standard seems to think keeping an excel sheet will do the trick for tracking complaints. This is insane. The standard policy at most collection shops is for one or maybe two people to process the complaint. They update the file accordingly and then add the complaint to the excel spreadsheet, the file is then placed on a path internally to handle it accordingly. It is 2016 and we have come so far in this world when it comes to technology, and yet, one of the most scrutinized practices still operates with the technology we had twenty years ago….no thank you.

Personally, I love asking “why” and to be able to dig down to the root cause. Is it a bad policy, procedure, client, employee, lack of training? The list could go on. I recommend to our clients to get into the mindset of how can they can avoid recurring complaints. Now you might say, “Bill that is insane. How can we ever stop the complaints when they are in the nature of, “the debt is not mine”.” My response is simple; you don’t have a chance if you continue to neglect using the technology available to compare files that contain the same complaint. You might as well keep writing your responses to the complaint back through the CFPB portal and stop reading this.

If you do have the ability to use analytics, I would suggest comparing the quality of the data from your client. What is the mail return rate? What is the right party contact rate with the telephone number provide? I want to investigate how the client is treating the consumer, do they have a process of doing a data scrub before placement and are they being provided with someone of the same name but not the correct consumer?

I love comparing clients against each other and then digging in. I didn’t know… I don’t know… or how would I know?? In my opinion, this is the same as going into the doctor when you are sick and the doctor prescribes a medication to resolve the symptoms but not the problem. Again, no thank you! I would much rather get to the root cause of why I am sick than take a prescription to mask the symptoms. Sometimes it is as easy as changing your behavior…

Regulatory compliance and client performance are issues that are only going to get more expansive, more detailed and more important for everyone in the ARM Industry to keep track of all the moving parts. Simply collecting data does not make it useful. You have to have a process in place to help transform your raw data into meaningful information – delivered to the right people in a timely manner – for improved decision making.

At Surefire, we are always looking for innovative ways to operate smarter. Below are a few screens from a complaint management application we developed for a client. Interested in learning more? Please email info@surefiredata.com!